estate tax changes proposed 2021

Second the federal estate tax exemption amount is still dropping on January 1 2026 from 11 million to 5 million adjusted for inflation. The proposed top income tax rate of 396 percent looks like the old top rate of 396 percent from 2017.

Outside Lands Announces 2021 Lineup Feat The Strokes Tyler The Creator Lizzo Tame Impala Pursuit Of Dopeness Tame Impala The Strokes Outside Lands

Decrease in Exemptions on State Death Taxes.

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

. Families who own homes and farms cannot elude taxes only use tools to minimize them. Only a few of the proposed changes would end up impacting either transactions or transfers that are made before the Act would be passed and many of these changes would not be implemented until January 1 2022 but people who are being advised to transfer substantial values to irrevocable trusts as gifts before. If passed the proposed increase on the rate of estate tax would move to 45 for estates valued between 35 million and 10 million 50 for.

The current 11700000 federal estate tax exemption amount would drop to 5 million adjusted for inflation as of January 1 2022. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million indexed for inflation to roughly 62 million as of January 1 2022. Capital gains tax would be increased from 20 to 396 for all income over 1000000.

Administration has proposed to tax capital gains when transferred by gift or at death. The Biden Administration has proposed significant changes to the income tax system. 234 million for married couples at a top rate of 40.

It kicks in at 400000 of income for. The tax reform proposals announced by the Administration in April and the General Explanations of the Administrations Fiscal Year 2022 Revenue. A person can currently transfer up to 117 million of assets at death without incurring any Federal Estate Tax.

One of the most effective means they employ to reduce their tax burden lies in the concept stepped-up basis. If a decedent were to die in 2021 with an estate of 11700000 there would be zero tax due on the estate and a full step up in tax basis on all assets to the value on the decedents date of death. That is only four years away and Congress could still.

On Behalf of Bradley Devitt Haas Watkins PC. This has implications for estate planning including gifts. The proposals two main components would invest 80 billion over the next 10 years in the IRS for tax enforcement and compliance and impose a 15 corporate minimum tax on the approximately 200 largest corporations.

Since the 2021 federal gift and estate tax exemption was raised to 117 million per person by the Tax Cuts and Jobs Act in 2017 the vast majority of individuals and families havent had to worry about having to pay the federal estate tax. Since 2018 estates are only taxed once they exceed 117 million for individuals. Included below are highlights of the proposed changes under the 881-page tax bill the full text of which is located here and a summary of the.

October 16 2021. The exemption was indexed for inflation and as of 2021 currently stands at 117 million per person. Under current law the existing 10 million exemption would revert back to the 5 million exemption.

So if a resident of DC. Under the current tax law the higher estate and gift tax exemption will Sunset on December 31 2025. As of January 1 2021 the death tax exemption in Washington DC.

The 2022 IRA legislative text on carried interests is identical to the 2021 proposal contained in the House-passed Build Back Better bill HR. The September proposal accelerated this sunset to the end of 2021 so the base exemption available to taxable gifts and estates would be 5 million 62 million adjusted for inflation beginning January 1 2022. July 13 2021.

These potential changes included a decrease in the estate and gift tax exemption as well as the elimination of a step-up basis. Estates may carry more in taxes under proposed tax change. However the revised proposals have eliminated this early sunset so if enacted the higher exemption would remain available through.

Blattmachrs Top Estate Planning and Estate Tax Developments of 2022 Jonathan Blattmachr Pioneer Wealth Partners New York NY MCLE credit. A generation-skipping tax is also imposed to address estate tax avoidance through gifts and. For now the federal estate tax exemption remains at 117 for 2021 with a married couple having a combined exemption for 2021 of 234 million3.

The bill would raise approximately 450 billion to pay for deficit reduction clean energy and climate investments. The 2017 Trump Tax Cuts raised the Federal Estate Tax Exemption to 1118 million for tax year 2018. New Proposed Tax Law May Dramatically Affect Massachusetts Estate Tax Planning Part 1.

Recent Changes in the Estate and Gift Tax. 2022 IRA proposed changes to carried interest taxation. In 2019 2570 taxable estate-tax returns were filed and they owed a combined 132 billion.

California Specialization Credit in Estate Planning Trust and Probate. Furthermore no reports exist that any changes will be made any time soon. But this could all change soon if revisions proposed by the Biden administration become law.

On September 12 2021 the House Ways and Means Committee introduced proposed tax changes to be incorporated in the budget reconciliation bill known as the Build America Back Better Act. Jul 7 2021 estate planning. For example a 20 million estate with have an estate tax payable of 3320000.

Gain will be recognized notwithstanding any other federal tax rules. Decreased from 567 million to 4 million. Lowering the Federal Gift and Estate Tax Threshold July 14 2021 By Family Estate Planning Law Group As many of you may know administrations come and go and when they do it is prime time for law changes.

Here is what you need to know about the proposal. The first is the federal estate tax exemption. The current 2021 gift and estate tax exemption is 117 million for each US.

Current federal estate tax law states that estates which exceed the exemption are subject to tax at the flat rate of 40. With a taxable estate worth 10 million dies in 2021 the heirs would have to pay almost 1 million in estate taxes. Here is what we know thats proposed.

So a family could end up paying both a transfer tax and then an estate tax and with the exclusion set to return to a level somewhere around 6 or 7 million many farms would be subject to both. Inflation in 1000 increments and will rise to 15000 in 2018 and remain at that level in 2021. But it wouldnt be a surprise if the estate tax law changed as part of the overall plan.

As proposed legislation passed through the legislative process in 2021 major potential changes to federal estate and gift tax were dropped.

5 Ways The Rich Can Avoid The Estate Tax Smartasset

2022 Updates To Estate And Gift Taxes Burner Law Group

Major Tax Changes For 2022 You Need To Know Gobankingrates

How To Avoid Estate Tax In Bitlife Pro Game Guides

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

Twelve States And Washington D C Impose Estate Taxes And Six States Impose Inheritance Taxes Maryland Is The Only State To Inheritance Tax Estate Tax States

How Does The Deduction For State And Local Taxes Work Tax Policy Center

401 K Inheritance Tax Rules Estate Planning

2018 Real Estate Tax Reform Guide The Bateman Group Estate Tax Online Real Estate Getting Into Real Estate

The Telegraph Tax Guide 2021 Your Complete Guide To The Tax Return For 2020 21 Edition 45 Hardcover Walmart Com In 2022 Tax Guide Tax Return Inheritance Tax

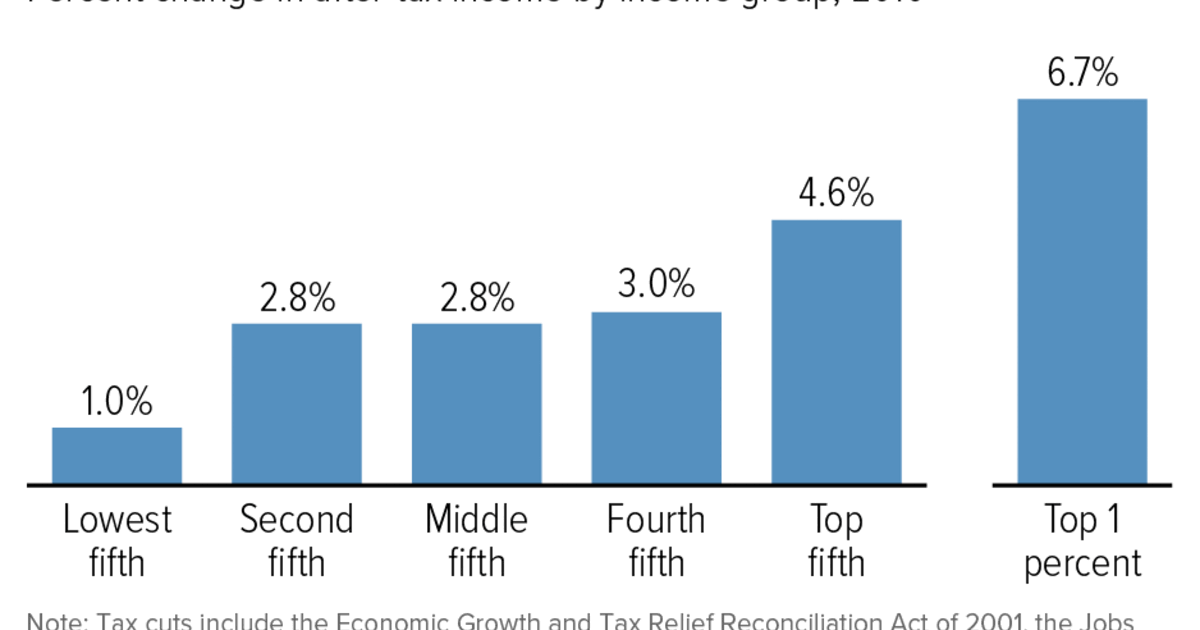

The Legacy Of The 2001 And 2003 Bush Tax Cuts Center On Budget And Policy Priorities

Inheritance Tax Here S Who Pays And In Which States Bankrate

Https Www Forbes Com Sites Peterjreilly 2021 09 25 Time To Change Your Estate Planagain Estate Planning Estate Tax Grantor Trust

Estate Planning Inheritance Vs Estate Tax Protective Life

The Treasury Green Book Of Biden Proposed Tax Changes In 2021 Capital Gain Estate Tax Corporate Tax Rate

/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

Estate Taxes Who Pays And How Much

State Corporate Income Tax Rates And Brackets Tax Foundation